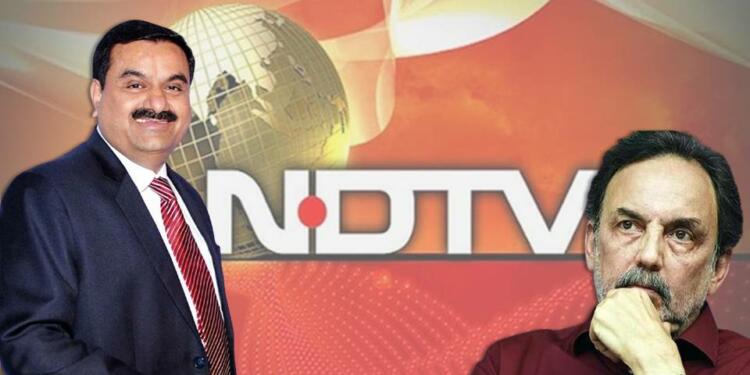

On Monday, November 14, 2022, the market regulator Sebi accepted Adani Group’s open offer to purchase an additional 26% share in the broadcaster New Delhi Television Ltd. This takeover effort has sparked worries about the deterioration of press freedom in the largest democracy in the world.

According to a statement on SEBI’s website, the Securities & Exchange Board of India accepted the Adani Group’s open offer, enabling Adani to purchase more equity from the media company’s minority owners.

The conglomerate, headed by Gautam Adani, the richest man in Asia, had changed the offer’s launch date to November 22. NDTV had announced this week that it would close on December 5.

Adani’s initial intention was to begin its open offer last month, but it was postponed while it awaited permission from the markets regulator. After acquiring an indirect 29.18% stake in the broadcaster back in August, the billionaire’s ports-to-power business launched a hostile takeover effort for it.

NDTV’s founders received a loan of more than 400 crore from a little-known company more than ten years ago in exchange for warrants that would have permitted the company to purchase a 29.18% share in the news organisation at any moment.

The buyout attempt has been rejected by Prannoy Roy and Radhika Roy, the founders of NDTV. They had insisted that neither of them knew anything about the takeover and that it had been carried out without their permission.

Adani has now taken a step toward expanding its presence in the Indian media industry. The billionaire is quickly expanding his enterprise beyond its foundation of coal mining and ports to branch into airports, data centres, cement, and digital services. The billionaire’s personal fortune, estimated at about $138 billion, has increased the most globally in 2022.

For the second quarter that concluded in September, NDTV recorded a rise in consolidated net profit of 4.4% to 13.03 crore. According to a regulatory filing, the company reported a net profit of 12.48 crore during the quarter from July to September of last year.

NDTV shares have been put up for sale by Adani Group at a price of 294 rupees ($3.6) each, while the media company’s stock rose 24% on Monday to close at 364.85 rupees.

Last Monday, the Adani company updated the open offer timetable, changing the dates to November 22 to December 5. The open offer of Rs 492.81 crore, which was supposed to begin on October 17 and finish on November 1, was postponed because Sebi had not yet approved it.

NDTV climbs 5% as Adani Group gets Sebi nod for open offer:

After the Adani Group received regulatory clearance from Sebi to purchase an additional 26% interest in New Delhi Television NSE 4.97% Limited, shares of NDTV NSE 4.97% touched the 5% upper circuit at Rs 383.05 on Tuesday.

To acquire up to a 26% interest in NDTV, Vishvapradhan Commercial Private Limited (VCPL), AMG Media Networks Limited (AMNL), and Adani Enterprises NSE 0.88% are putting forth an open offer at a price of Rs 294 per share.

Tuesday’s trading saw a total of 32,000 shares traded on the counter, compared to a two-week average of 9,147 shares.

According to a statement on the market regulator’s website, the open offer from the Gautam Adani-led group was approved by Sebi on Monday. The open offer debut date has been moved up by the corporation to November 22, and it will now end on December 5.

The Adani Group had initially planned to launch the offer last month, but this was postponed as it awaited Sebi’s permission. Following its August acquisition of an indirect 29.18% share in the media company, the ports-to-power conglomerate launched a hostile takeover effort for it.

According to Adani Group’s flagship company Adani Enterprises, “the decision to acquire NDTV was reached in furtherance of the Adani Group’s objective to set up a credible next-generation media platform with an emphasis on digital and broadcast segments, and that NDTV is a suitable broadcast and digital platform to deliver on this vision.”

As the Adani-led conglomerate diversified across industries, such as data centres, airports, cement, etc., it will also acquire a larger piece of the nation’s media industry.

According to NDTV’s most recent shareholding data, promoters Prannoy Roy and Radhika Roy owned 15.94% and 16.32% of the company, respectively, at the end of the September quarter. In NDTV, RRPR held a 29.18% stake.