If you’re an investor looking to put your money in the Indian stock market, you may have come across two of the biggest FMCG companies in the country – ITC share market and HUL. While both companies have a strong presence in the market, investors often face a dilemma as to which company to choose for investment. In this article, we will conduct a comprehensive analysis of target price, to help you make an informed decision.

Introduction

In this section, we will give a brief overview of ITC and HUL, including their history, products, and financial performance.

ITC

ITC Limited is an Indian multinational conglomerate company headquartered in Kolkata, West Bengal. It was established in 1910 as the Imperial Tobacco Company of India Limited. ITC has a diversified business portfolio which includes fast-moving consumer goods (FMCG), hotels, paperboards, and packaging, agri-business, and information technology.

ITC’s FMCG portfolio includes cigarettes, cigars, tobacco, packaged food, personal care products, stationary, and safety matches. The company’s revenue for the year 2020 was Rs. 52,935 crores, and its market capitalization as of 21st April 2023 was Rs. 3.83 lakh crores.

HUL

Hindustan Unilever Limited (HUL) is an Indian consumer goods company headquartered in Mumbai, Maharashtra. It was established in 1933 as Lever Brothers India Limited. HUL is a subsidiary of the British-Dutch company, Unilever.

HUL’s FMCG portfolio includes home care products, personal care products, food and beverages, and water purifiers. The company’s revenue for the year 2020 was Rs. 41,289 crores, and its market capitalization as of 21st April 2023 was Rs. 6.82 lakh crores.

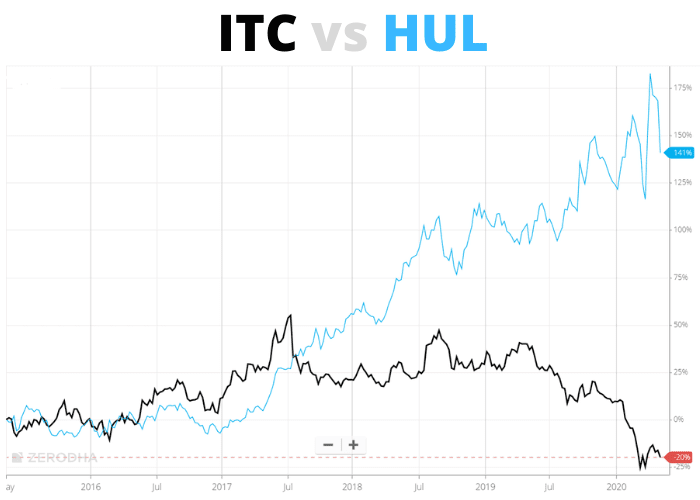

Financial Performance Comparison

In this section, we will compare the financial performance of ITC and HUL, including their revenue, profit, and market capitalization.

Revenue

In terms of revenue, both ITC and HUL have shown steady growth over the years. However, HUL has a higher revenue as compared to ITC. In the financial year 2020, HUL’s revenue was Rs. 41,289 crores, while ITC’s revenue was Rs. 52,935 crores.

Profit

When it comes to profit, both companies have shown consistent growth. However, ITC has a higher profit margin as compared to HUL. In the financial year 2020, ITC’s profit after tax was Rs. 15,404 crores, while HUL’s profit after tax was Rs. 7,891 crores.

Market Capitalization

Market capitalization is an important metric to consider while investing in a company. In terms of market capitalization, HUL has a higher market capitalization as compared to ITC. As of 21st April 2023, HUL’s market capitalization was Rs. 6.82 lakh crores, while ITC’s market capitalization was Rs. 3.83 lakh crores.

Conclusion

In conclusion, both ITC and HUL are strong players in the FMCG market in India. While ITC has a more diversified business portfolio and higher profitability, HUL has a stronger brand image and higher market share. Investors should carefully consider their investment objectives and risk tolerance before making a decision.

Comments are closed.