Supreme Court upholds the demonetization: On Monday, the Supreme Court’s five-member Constitutional Bench upheld the Modi government’s decision to abolish 500 and 1,000 rupee banknotes in 2016, a decision related to executive branch policy. It is a thing and cannot be overturned.

The court dismissed 58 petitions for the demonstration, saying there was nothing wrong with the government’s decision-making process.

The judgment written by Justice B.R. Gavai was concurred by Justices S. Abdul Nazeer, A.S. Bopanna, and V. Ramasubramanian.

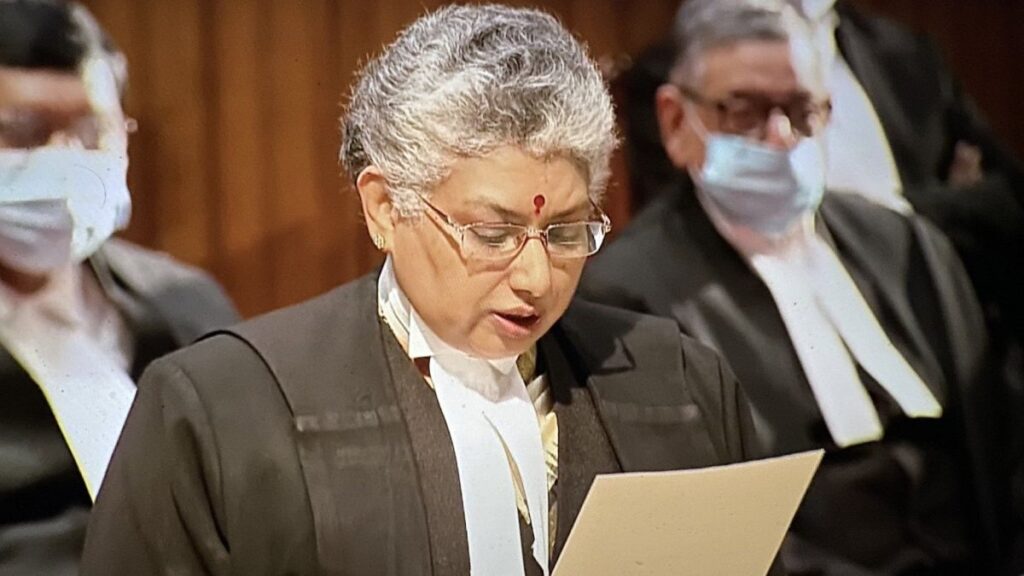

Judge B V Nagarathna criticized demonization in a dissenting verdict, but he did not overturn it.

The ruling was based on the fact that he had six months of consultations between the Center and the Reserve Bank of India (RBI) which suggested a “reasonable link between the actions taken and the objectives sought”. , said the revocation notice passed the test or passed jurisprudence—”Proportional”.

A proportionality test refers to whether the measure (money decommissioning) is proportional to the intended outcome, such as eliminating black market trading, terrorist financing, etc., and whether the measures (money decommissioning) are in proportion to the intended outcome, and whether consultations between the central bank and the RBI prior to the banknote ban are carried out. Abhinay Sharma said it means checking if there was a Managing Partner, ASL Partner.

“There is no legal or constitutional flaw in (this) decision to repeal. The Supreme Court of India has asked the appropriate tribunal to decide the issues related to the main question of the effectiveness of the demonization process. You can file a petition,” the court said.

This means that petitioners who have not received immunity from this judgment can bring the matter to the appropriate Supreme Court of India to rule on issues related to the validity of de-monetization. But legal experts said the issue can only be challenged if a motion for reconsideration is filed against the verdict. The center told the Supreme Court that the move came after extensive consultations with the RBI and that preparations were made before the banknote ban came into force.

She added that the demonization exercise was a “well-considered” decision and part of a broader strategy to combat the threat of counterfeit currency, terrorist financing, black money, and tax evasion.

Also Read: Union Budget 2023: what should you anticipate

Another view

Judge Nagaratna disagreed with the majority, saying he missed the key issue that the RBI, not the central bank, should initiate the currency abolition process.

“This was a legally flawed decision to repeal since she was overturned in 2016,” she said.

They hardly agreed with section 26(2) of the RBI Act. According to the law, the government, on the recommendation of the Board, may declare through a notice in the Gazette that the denomination of a note is no longer legal tender by her RBI. She said the demonstration process was illegal but could not be undone now. The process was well-meaning and its purpose was to combat black money, terrorist financing, hawala trading, and other such practices.”

Political and legal reactions quickly followed.

His lawyer, Prashant Bhushan, told the media: “The RBI had little time to deal with the matter. The decision was made haphazardly and without thought. This decision is unfortunate because it will allow the government to make such reckless decisions in the future. “

Kirat Singh Nagra, a partner at law firm DSK Legal, said: “This ruling sends a strong message to the public and the business community about the need to conduct financial transactions through lawful means, and the court will lead the populist agenda and public outcry on key economic policy issues. You will not be cut.”

Political reactions

Congress, the largest opposition party, said it was “misleading and wrong” to say the Supreme Court supported demonization.

“The verdict says nothing about whether the declared goal of demonization has been achieved,” said party general secretary Jairam Ramesh.

Former Finance Minister P. Chidambaram, who appeared on behalf of the petitioners, tweeted:

I must point out that the majority did not confirm the wisdom of the decision. Nor has the majority reached the conclusion that the declared objectives have been achieved. In fact, the majority did not even approach the question of whether the goal was achieved. “

The ruling Bharatiya Janata Party welcomed the “historic” order to keep the banknote ban. Former justice minister and BJP leader Ravi Shankar Prasad said the demonstration proved to be a “massive strike” against terrorism by cutting back on terrorism funding. It raised income taxes and cleaned up the economy, he argued.

On 8 November 2016, Prime Minister Narendra Modi announced a ban on 500 rupee and he 1,000 rupee banknotes, saying this would reduce the use of black market money and counterfeit banknotes. However, with the RBI frequently changing the rules over the next few months, there were some reported problems for citizens due to long queues and cash shortages.

Hearings will begin on October 12, 2022, and the bank has reserved a verdict for him on December 7.

In its filings, the RBI acknowledged that there were “temporary hardships” and that they were an integral part of the nation-building process, but that there were mechanisms to resolve the problems that arose.