As the highest bidder for the 259-hectare project on Tuesday, The Adani Group won the Dharavi Redevelopment Project. One of the biggest slums in the world, Dharavi, will be renovated for 5,069 crores by the Adani Group. According to SVR Srinivas, the CEO of the Dharavi Redevelopment Project, it outbid DLF Ltd, which had proposed a price of 2,025 crore.

The information will be provided to the government, according to SVR Srinivas. The Eknath Shinde government in Maharashtra will approve it in a few weeks, he added, adding, “We will now be forwarding the specifics to the government, which will examine and provide final clearance.”

WHAT IS DHARAVI REDEVELOPMENT PROJECT

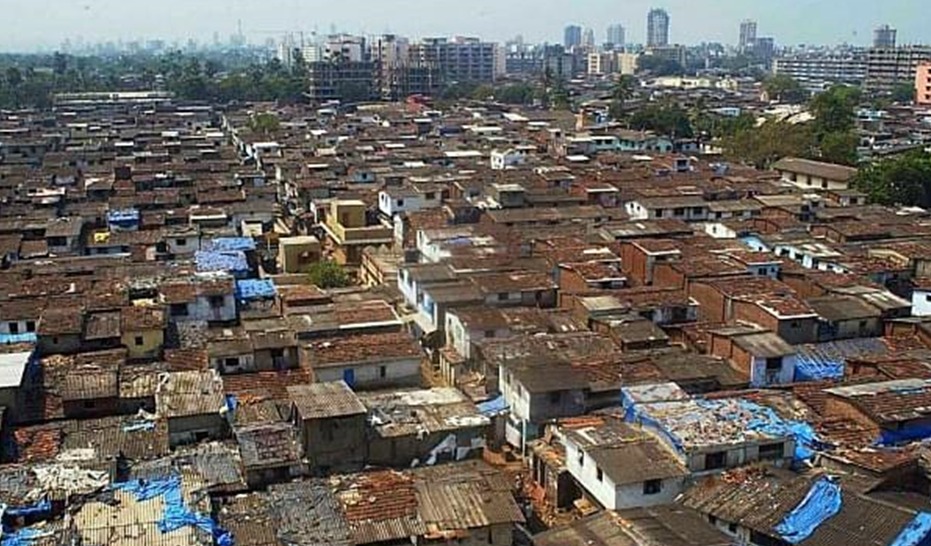

Almost two decades have passed since the Dharavi rehabilitation project was put on hold. The largest slum in the world, Dharavi, is situated on prime real land. A significant upfront financial investment will be necessary for its renovation, along with challenging challenges related to land acquisition and rehabilitation.

Here are the details of the project and the reasons why they have been so slow in coming.

The wealthiest business sector in India, the Bandra-Kurla Complex, where commercial office rents are among the highest in the nation, is only a short distance from Dharavi.

Although it is yet unknown how much land the successful bidder could purchase, the Dharavi slum is situated between the city’s new financial sector and its main airport and spans approximately 620 acres.

The entire 20,000 crore project is included in the bid. The Dharavi Redevelopment Project will last seven years. The 2.5 sq km region currently occupied by 6.5 lakh slum dwellers is being styled after Dharavi in order to rehabilitate them.

By selling millions of square feet of residential and commercial property in downtown Mumbai, the Dharavi Redevelopment Project will assist the Adani Group in realising substantial profits.

Due to the project’s complexity, which includes factors like class, religion, and race, it has remained in limbo for many years.

One of the biggest slums in the world is Dharavi, which has a million residents. It is so crowded that 80 people can share one public restroom.

The largest stock exchange in India is located in Mumbai’s central business district, which is around 5 kilometres away from Dharavi. Most of the people that live in Dharavi are migrant workers who earn daily pay.

TOP POINTS-

The idea for the project originated with architect Mukesh Mehta, head of MM Project Consultants Private Limited, in the 1990s.

Hundreds of people of the Dharavi slum were to be relocated to opulent flats as part of the Dharavi rehabilitation project, which was first proposed by the then-chief minister Vilasrao Deshmukh in February 2004.

For the past 18 years, the Dharavi Redevelopment Project has been inactive.

The Maharashtra government intended to transform a sizable portion of the land into a premier business district and a residential colony through this Dharavi Redevelopment Project.

Vilasrao Deshmukh was the chief minister for two terms before passing away in 2012. Just over 300 residents have relocated to new homes in the Maharashtra Housing and Area Development Authority’s sector 5 over the course of the past 18 years (MHADA).

The Dharavi Redevelopment Project has seen numerous setbacks in the more than 18 years after the announcement.

The Dharavi Redevelopment Authority (DRA) was established by the government, and 101 companies participated in the global tenders that were floated in 2007. The project was derailed in 2009 by a state-appointed group of experts who labelled it a “sophisticated land grab.”

Another problem that caused the project to fail was eligibility. The number of legal entities that qualified for the new homes was significantly lower than the quantity of huts in Dharavi. Only 37% were found to be qualified for new homes, according to a BMC survey.

Due to the global recession, the procedure was cancelled in 2011. Many bidders withdrew, citing a lack of clarity and a delay in execution.

A new tender was floated in 2016, but no bidders responded. In 2018, it was floated once more. The winning bid was then submitted by Seclink Technologies Corporation, and Adani Group had lost the auction. The cost of the Railways land, however, was not included in the initial bid, thus it did not take off. 2020 saw its cancellation.

Adani’s loss in 2019

Seclink Technologies Corporation, a Dubai-based infrastructure company, defeated Adani in a bid in January 2019, but the tender was not awarded as a result of the choice to include Railway land in the rehabilitation project.

The Maharashtra administration had changed by 2020, and in October of that year, the Maharashtra Vikas Aghadi government, led by Uddhav Thackrey, cancelled the tender and announced that new tenders will be floated soon. The MVA government had claimed that the Centre’s delay in delivering railway land necessary for the project was one of the grounds for cancelling the tender. The issue of land transfer from the Center was thought to have been handled once the government again changed with Eknath Shinde becoming the new CM, and new tenders were requested.

THE BIDDERS IN 2022

The Dharavi Redevelopment Project had received bids from eight parties at the beginning, including companies from South Korea and the UAE who had attended a pre-bid conference in October. The project was only actually bid on by three of them. The Naman Group, the DLF Ltd., and the Adani Group. The Dharavi Redevelopment Project rejected the Naman Group’s offer as ineligible.

Prior to selecting the highest bidder, the government would probably assess each bidder’s technical and financial eligibility. The government has set a minimum consolidated net worth requirement of 20,000 crore.

A special purpose vehicle (SPV) must be established by the successful bidder in order to carry out the project. The developer is responsible for handling infrastructure, amenities, and rehabilitation and renewal.