Swing trading is an important part of any trading strategy because it allows traders to take advantage of short-term price movements without having to commit to long-term positions. How to choose swing trade stocks is not an easy thing to do as it requires a lot of knowledge and effort.

It is also a great way to build up a portfolio of positions without risking too much capital at once. Swing traders can also benefit from the ability to quickly exit trades if the market turns against them, which can help to reduce losses and protect their capital.

In this article, we are going to discuss how to select stocks for swing trading that will help you to earn good returns and make money.

Swing Trading Meaning

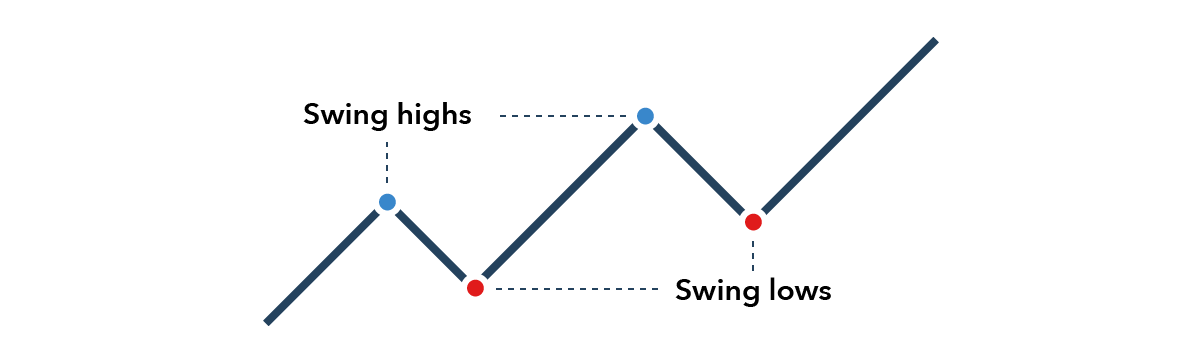

Swing trading meaning-it is a trading strategy that tries to take advantage of short-term price movements in a stock or other security.

It involves identifying a potential trend and then holding the security for a short period of time, usually one to four days, in order to capture a portion of the price movement.

Traders may also use technical analysis to identify potential entry and exit points & also for how to choose stocks for swing trading. Swing trading meaning is, it is a form of momentum trading and is generally considered to be a more conservative approach to trading than day trading.

Swing Trading Example

The Swing Trading example supposes a trader might look for a stock that has been trading in a tight range for several days and then breaks out to the upside.

Another swing trading example strategy is to look for stocks that have made a large move up or down and then wait for them to consolidate before taking a position. This type of trading often takes advantage of the momentum.

Swing trading can be profitable in both rising and falling markets. In a rising market, swing traders typically buy stocks that have recently pulled back from a new high. In a falling market, swing traders might short-sell stocks that have just made a new low. These swing trading examples help you how to select stocks for swing trading.

What Are Some Swing Trading Strategies?

These are some major swing trading strategies that are used by swing strategies that are used by swing traders that will how to choose stocks for swing trading.

1. Momentum Trading

Momentum trading involves buying stocks that are rising in price and selling stocks that are declining in price. This strategy takes advantage of short-term price movements in the market to generate profits.

2. Breakout Trading

Breakout trading is a strategy that involves buying stocks that are breaking out of a trading range, such as a resistance level or support level. This strategy takes advantage of the sharp price movements that occur when a stock breaks out of its trading range. This is one of the important strategies how to select stocks for swing trading.

3. Support and Resistance Trading

Support and resistance trading is a strategy that involves buying stocks when they reach support levels, and selling stocks when they reach resistance levels. This strategy takes advantage of the price movement that occurs when a stock tests a support or resistance level. Also helps you how to choose stock for swing trading

4. Moving Average Crossover Trading

Moving average crossover trading is a strategy that involves buying stocks when the short-term moving average crosses above the long-term moving average and selling stocks when the short-term moving average crosses below the long-term moving average. This strategy takes advantage of the trend-following nature of the moving averages and helps you how to select stocks for swing trading.

5. Trend-following Trading

Trend-following trading is a strategy that involves buying stocks when they are trending up, and selling stocks when they are trending down. This strategy takes advantage of the trend-following nature of the markets.

6. Reversal Trading

Reversal trading is a strategy that involves buying stocks when they are oversold in the short-term, and selling stocks when they are overbought in the short term.

This strategy takes advantage of the fact that stocks often reverse their short-term direction after being overbought or oversold. And helps you how to select stocks for swing trading

There are a number of different swing trading strategies that traders can use. The best swing trading strategy for any given trader will depend on his or her own goals, risk tolerance, and market outlook.

10 Ways How To Select Stocks For Swing Trading

These are the important 10 methods that will help you how to select a stock for swing trading.

1. Choose stocks with good liquidity

Liquidity is one of the most important factors to consider when how to select stocks for swing trading. Look for stocks that have a high trading volume, as this will make it easier to enter and exit trades quickly.

2. Look for stocks with a history of consistent pricing action

Monitor the price action of your stocks over the last several months to get a better idea of their historical performance. Look for stocks that have been trading in a consistent range for at least a few months, with minimal volatility.

3. Consider the technical analysis

Technical analysis is a great tool for swing traders. Look for stocks that have recently broken out of a trading range, or that have recently established a new support or resistance level. This is one of the ways how to select stocks for swing trading.

4. Monitor news and economic data

Keep an eye on news and economic data that could have an impact on the price of your stocks. If you see news about a company or sector that could affect your stocks, it might be a good time to get out of a trade. This is how to select shares for swing trading.

5. Set realistic profit goals

Set realistic profit goals for your trades so that you can maximize your profits while still keeping your risk in check. Start with small gains and gradually increase your profit targets as you become more experienced. With this technique, you can understand how to select the best stock for swing trading.

6. Monitor your positions

Monitor your positions closely to ensure that they are still in line with your trading plan. If the stock moves against you, be prepared to exit the position quickly to minimize your losses.

7. Utilize stop-loss orders

Utilize stop-loss orders to protect your trades from larger losses. This will help you to limit your risk and ensure that you don’t lose more than you can afford. This is one of the important methods how to select stocks for swing trading.

8. Follow a strict trading plan

Develop a trading plan and stick to it. This will help you to remain disciplined and keep your emotions in check while trading.

9. Track your results

Track the performance of your trades to see what works and what doesn’t. This will help you to refine your trading strategies and increase your chances of success. This will help you how to select shares for swing trading.

10. Take profits regularly

Take profits regularly to ensure that you are taking advantage of any gains you make. This will help you to stay disciplined and prevent you from getting too greedy.

These are the 10 important ways that will help you how to select stocks for swing trading.

What are the objectives of swing trading?

There are a few different objectives that swing traders might have, but the two most common are to take advantage of short-term price changes in order to make a profit or to use swing trading as a way to reduce the overall risk of a portfolio by hedging against potential losses in other investments. That is it becomes more important how to select stocks for swing trading.

In order to make a profit from swing trading, traders will typically buy when prices are low and then sell when prices rise – in essence, they are trying to “catch the wave” of price movement in order to make a profit. This type of swing trading can be quite speculative, and it is important to have a solid understanding of market trends and price movements before attempting it.

Swing trading can also be used as a way to hedge against potential losses in other investments. For example, if a trader has a portfolio of stocks that they are worried might go down in value, they could use swing trading to buy put options on those stocks.

This would give them the potential to make money if the stock prices did indeed fall, while still allowing them to participate in any upside if the stock prices rose. It will also help you how to select stocks for swing trading.

Overall, swing trading can be a profitable endeavor if done correctly, but it does come with a higher degree of risk than some other types of trading.

Best Technical Indicators For Swing Trading

These are the top 5 best indicators for swing trading that help you how to select stocks for swing trading.

1. Moving Average Convergence Divergence (MACD)

The MACD is a momentum indicator that compares two different moving averages (typically a 26-period exponential moving average and a 12-period exponential moving average) to identify shifts in momentum.

When the MACD line crosses the signal line, it is a signal of a potential trend change. This is one of the indicators for how to select stocks for swing trading.

2. Relative Strength Index (RSI)

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

The RSI ranges from 0 to 100 and is used to identify when security is becoming overbought or oversold. This is one of the high probability swing trading strategies. This is one of the important indicators for how to select stocks for swing trading.

3. Stochastics

Stochastics is an oscillator that measures momentum by comparing a security’s closing price to its price range over a period of time. It is used to identify overbought and oversold conditions.

4. Bollinger Bands

Bollinger Bands are a volatility indicator that consists of two lines that are placed two standard deviations away from a moving average. They are used to identify potential periods of high volatility and also help how to select stocks for swing trading.

5. Volume

Volume is an important indicator for swing traders as it can indicate the strength of a trend. If the volume is increasing during a trend, it is an indication that the trend is gaining momentum. Conversely, if the volume is decreasing during a trend, it is an indication that the trend is losing strength.

Above, we have mentioned the best technical indicators for swing trading that will help you, how to select stocks for swing trading.

How does swing trading works?

Swing trading is a strategy that focuses on taking advantage of price swings in order to make profits.

It can be used in any market and on any time frame but is most commonly used on higher time frames such as the 4-hour or daily chart.

The basic idea behind swing trading is to buy when prices are low and sell when they are high. However, it is not as simple as that.

A successful swing trader must be able to identify when a price is about to swing and then place a trade accordingly.

There are a number of different indicators that can be used to help with this, but one of the most popular is the Relative Strength Index (RSI). That is also used help you how to select stocks for swing trading.

The RSI is a momentum indicator that measures how fast prices are moving. When the RSI is above 50, it means that prices are rising and when it is below 50, it means that prices are falling.

Swing trading is not for everyone and it does come with risks. The biggest risk is that a stock could continue moving against the trader, resulting in a loss.

However, swing trading can be a very profitable strategy for those who are willing to put in the time and effort to learn how to do it correctly.

What are the opportunities for swing traders?

There are many opportunities for swing traders in the stock market. With the right strategy, a swing trader can understand how to select stocks for swing trading and make a profit in both rising and falling markets.

In a rising market, a swing trader can buy stocks that are undervalued and then sell them when they reach their target price. In a falling market, a swing trader can sell stocks that are overvalued and then buy them back when they reach their target price.

Swing trading is a versatile strategy that can be used in many different markets. For example, a swing trader can trade stocks, bonds, commodities, or currencies.

The key to successful swing trading is to find a strategy that works for you and then stick with it. There is no one perfect strategy for swing trading.

Some swing traders use technical analysis to find stocks that are under or overvalued. Others use fundamental analysis to find companies with strong prospects to understand how to select stocks for swing trading.

The most important thing is to have a plan and stick to it. Discipline is the key to success in swing trading.

Final thoughts

Swing trading is a great way to trade the markets if you are looking to take advantage of short-term price movements.

It can be a very successful strategy if you are able to identify potential support and resistance levels and trade accordingly. And also identify how to select stocks for swing trading.

The key to swing trading is to stay disciplined and manage your risk. Establishing proper risk management will help you stay in the game and make consistent profits over the long term.

Swing Trade Stock Selection F&Q

Difference between scalping vs swing trading?

The main difference between scalping vs swing trading is the time frame. Scalping is a short-term trading strategy that involves taking advantage of small price movements in a short amount of time, whereas swing trading is a longer-term trading strategy that involves taking advantage of price movements in the mid-term.

In addition, swing trading requires more research and analysis than scalping, as swing traders need to make sure that the trend is correct and that the price movements are in their favour.

Difference between swing trading vs day trading?

Swing trading vs Day trading-Day trading is a trading strategy where traders buy and sell securities within a single trading day.

Day traders usually enter and exit positions within a few minutes or hours and do not hold a position overnight. Day trading is often used to take advantage of small price movements in highly liquid stocks or currencies.

- Swing trading is a trading strategy that attempts to capture gains in a security within a few days to several weeks.

- Swing traders will typically look for trends in the market and enter and exit positions based on the trend.

- Swing traders will usually hold a position for several days or weeks and take advantage of medium-term price movements.

Comments are closed.