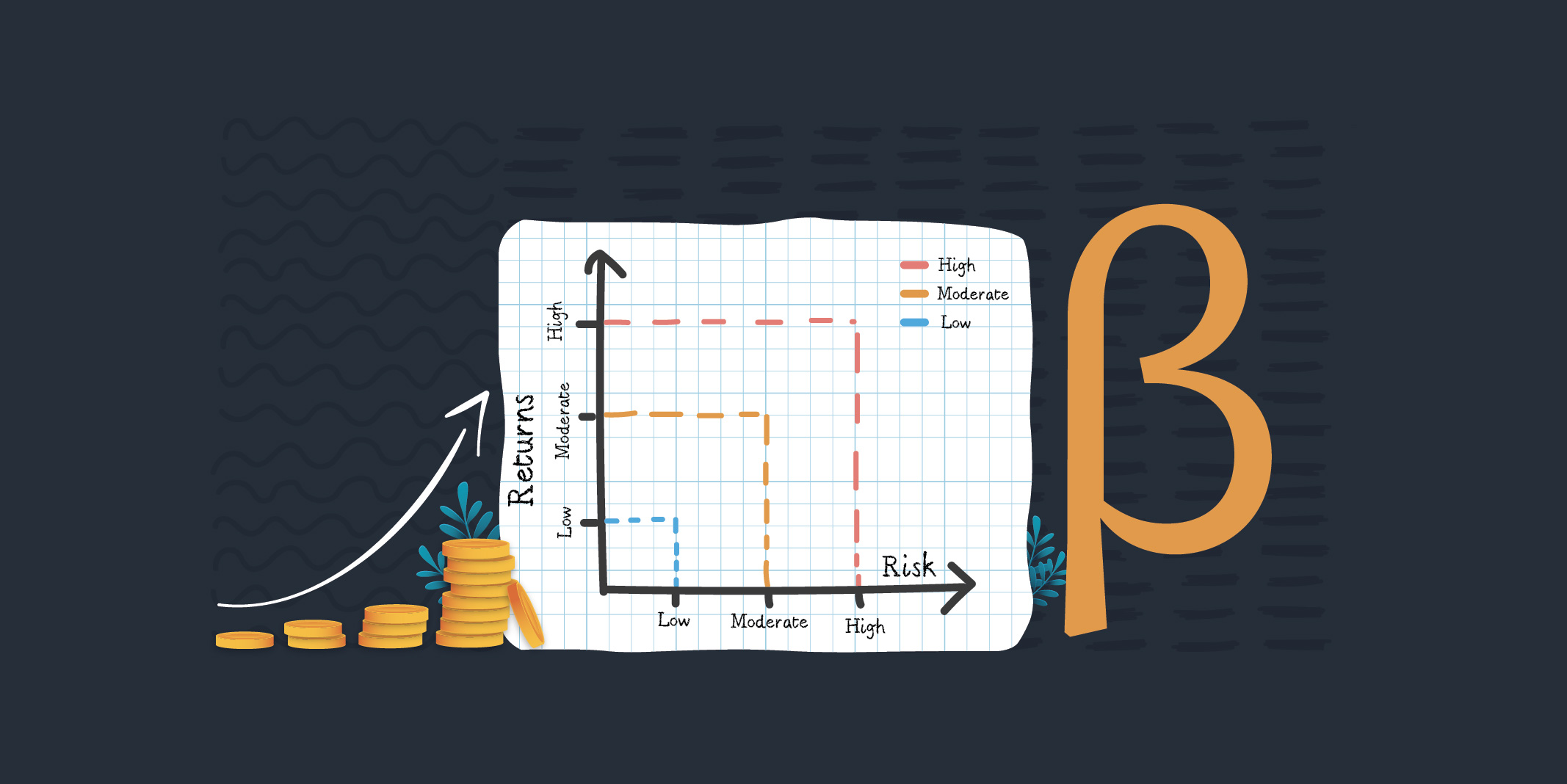

Stock Beta risk is an important factor to consider when investing in any portfolio. Systematic risks and unsystematic risks are the two types of risks.

stock beta is a metric that quantifies how much a stock will fluctuate in response to movements in the general stock market.

stock beta is a measure of a stock’s volatility in relation to the overall market.

A stock’s stock beta will change over time because it compares the stock’s return with the returns of the overall market.

- A stock’s anticipated movement in relation to changes in the entire market is measured by the concept of stock beta.

- A stock with a stock beta larger than 1.0 is thought to be more volatile than the overall market, whereas one with a stock beta below 1.0 is thought to be less volatile.

- The Capital Asset Pricing Model which computes the cost of equity financing and can assist in determining the rate of return to anticipate relative to perceived risk includes the concept of stock beta.

- Critics claim that stock beta is of limited value when choosing stocks because it does not provide enough information about a company’s fundamentals.

- Instead of long-term risk, stock beta is arguably a better measure of short-term danger.

What is the formula of stock beta?

stock beta is a measure of how much different portfolios are impacted differently from how the market as a whole is impacted by these systemic risks. Or to put it another way, different securities have varying systemic risks depending on how they interact with the market. The change in a stock’s or even a portfolio’s returns relative to market returns is described by the stock beta factor. Since the index is an excellent mirror of the market, market returns are essentially quantified by index returns (Nifty, Mid-cap, etc.).

stock beta= Variance/ Covariance

Regression analysis is used to compute stock beta. In terms of numbers, it shows how responsive a security’s returns are to market fluctuations. The covariance of an asset’s return with its benchmark return divided by the benchmark return’s variation over a specific time period is the formula for determining stock beta.

Types of stock beta

The respective benchmark index upon which each security’s stock beta value is measured varies. There are four main types that it can take.

- stock beta > 1: A stock beta number greater than 1 denotes a high level of stock market responsiveness for the corresponding security. These shares, which often include securities from small and mid-cap companies, are projected to offer significant returns on the whole investment.However, such shares also have a high-risk element because the underlying companies frequently lack the resources necessary to cover all costs in the event of market turbulence. As a result, whenever the benchmark index points decline, the value of the linked stocks also drastically declines.

- stock beta < 1: This coefficient illustrates how stable a stock is in comparison. Indian equities with stock betas less than 1 are considered to be generally stable investments because their returns are not significantly impacted by changes in the stock market.

- stock beta = 1: When compared to a benchmark index, these securities have a comparable parallel effect on a stock price and its ROE with market movements. Since they make up the majority of the country’s main benchmark indices, large-cap businesses also have a stock beta value of 1.

- stock beta = 0: Investment instruments with zero associated risks show a stock beta value of 0. This group includes items like government bonds, fixed deposits, cash, etc., and is perfect for people looking for investment opportunities to ensure the security of their corpus.

- stock beta < 0: Securities with negative stock beta coefficients appear to have adverse relationships with the stock market. Investors frequently combine their funds in these securities for increased returns in the case of a severe stock market fluctuation or crash. Given that gold’s value tends to increase with time, it is an important example of an investing tool with a negative stock beta. It serves as an inflation hedge in addition to being a safe tool for investing.

What are the advantages of stock beta?

stock beta is useful to CAPM adherents. It’s crucial to take stock price volatility into account when determining risk. It makes sense to use stock beta as a stand-in for risk if you consider the risk to be the probability that a stock would depreciate in value. It makes a lot of sense logically. Consider a stock in a developing technology industry with a price that fluctuates greater than the market. It’s difficult to avoid the conclusion that this stock would be riskier than, say, a utility stock that is a safe haven and has a low stock beta.

stock beta also provides a straightforward, quantitative indicator that is simple to use. Yes, there are differences in stock beta based on the market index utilized and the measurement period. However, in general, the idea of stock beta is rather simple. It’s a useful tool for figuring out the equity costs utilized in a valuation technique.

What are the disadvantages of stock beta?

stock beta has many drawbacks if you are investing depending on a stock’s fundamentals.

stock beta, doesn’t include fresh data. Take the example of a utility firm, Company X. Company X has a low stock beta and is regarded as a defensive stock. X’s historical stock beta no longer accurately reflected the significant risks the company took on when it entered the merchant energy market and took on more debt.

However, most technology stocks are still fairly new on the market and lack the necessary price history to calculate a trustworthy stock beta.

The fact that previous price action is a poor indicator of future behavior is another unsettling aspect. stock betas are essentially rear-view mirrors and don’t reflect much of the future. Additionally, the stock beta metric for a single stock has the propensity to change over time, making it untrustworthy. Of course, stock beta is a decent risk metric for traders trying to purchase and sell equities quickly. It is less helpful for investors having long-term time horizons, though.

What is Assessing risk?

The most common definition of risk would be the potential for loss. Naturally, when investors think about risk, they are considering the possibility that the stock that you buy will lose value. Problematically, stock beta does not differentiate between upward and downward price fluctuations when used as a risk proxy. The majority of investors view downward movements as a risk and upward ones as an opportunity. Investors cannot differentiate between the two using the stock beta. That doesn’t make a whole lot of sense for most investors.

Warren Buffett once said, “Well, that may be all right in reality, but it will never work in theory,” which is an interesting statement regarding the academic community’s view of value investment.

stock beta is derided by value investors because it suggests that a stock that has experienced a severe decline in value is riskier now than it was earlier. A value investor would contend that a company offers a lower-risk investment when it experiences a decrease in value since investors may still purchase the same shares for a cheaper price even though its stock beta increased as a result of the decline. The stock’s stock beta has nothing to do with the amount paid for it in connection to underlying variables like shifts in management, the introduction of new products, or anticipated cash flows.

The “father of value investing,” Benjamin Graham, and his contemporary supporters looked for well-run businesses with a “margin of safety,” or the capacity to tolerate bad surprises. Some safety factors are derived from the balance sheet, such as a low debt-to-total capital ratio. Some result from ongoing growth, earnings, or dividends. Avoiding overpaying has several significant benefits. For instance, companies with low multiples of earnings are often thought to be safer than those with high multiples, though this isn’t always the case.